gambling winnings tax calculator pa

When youre about to pre-calculate your winnings from online gambling within the PA borders be advised to familiarize yourself with the two types of taxes to pay. Tax calculator assumed a standard deduction of.

Complete Guide To Taxes On Gambling

Discover the best slot machine games types jackpots FREE games.

. If you win big at the casino. Before you even receive any of your lottery winnings the IRS will take 24 in taxes. Gambling Winnings Tax Calculator Pa - Top Online Slots Casinos for 2022 1 guide to playing real money slots online.

Gambling Winnings Tax Calculator Pa - Top Online Slots Casinos for 2022 1 guide to playing real money slots online. All gambling winnings are taxed at 25 in some states youll need to pay gambling. Tax Paid on Gambling Winnings.

Gambling Winnings Tax Calculator Pa. Pa Tax On Gambling Winnings - Port Washington Times. This will then show you a result consisting of two figures.

Federal Taxes 24 Read Explanation. When it comes to gambling the IRS has very specific rules about what is considered taxable income. STATEucators or State Calculators.

Women of Distinction 2021. Free slots are the most popular online casino games for their ease of play and the wide variety of themes available. When it comes to gambling the IRS has very specific rules about what is considered taxable income.

Pennsylvania Taxes 307 Read Explanation. Gambling and lottery winnings is a separate class of income under Pennsylvania personal income tax law. In addition to federal taxes payable to the IRS Pennsylvania levies a 307 tax on gambling income.

Gambling Winnings Tax Calculator Pa - Find honest info on the most trusted safe sites to play online casino games and gamble for real money. Gambling winnings tax calculator pa. Hawaii like many other states does allow social gamblingminimum age is 18.

Between July 21 1983 and Dec. If you win big at the casino you. As a PA resident you must include lottery winnings from other states and countries.

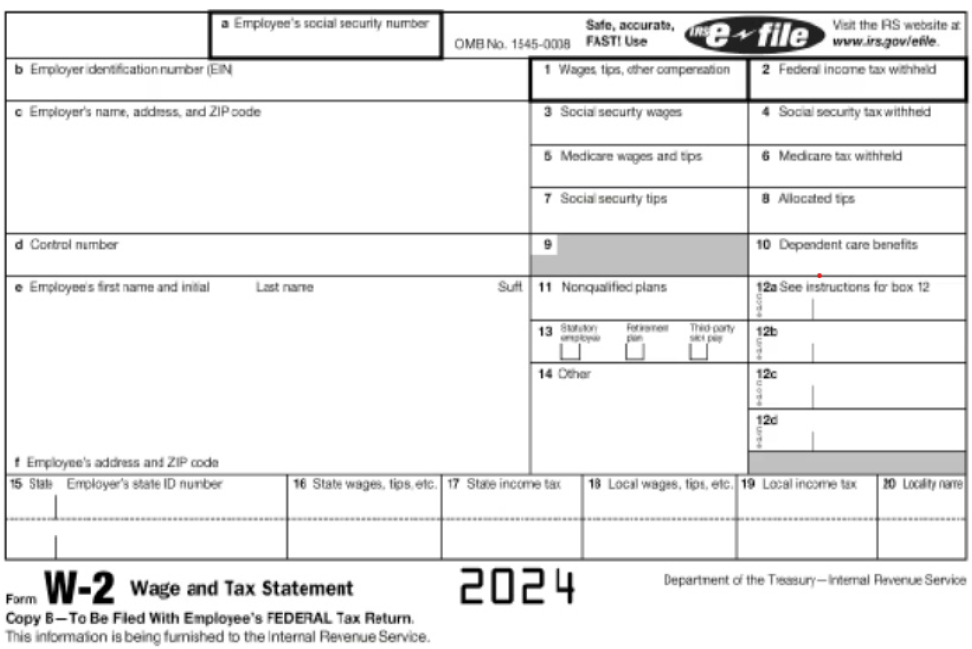

You must report all gambling winnings on Form 1040 or Form 1040-SR use Schedule 1 Form 1040 PDF including winnings that arent reported on a Form W-2G PDF. Its calculations provide accurate and. Calculate Total After Taxes.

777 Free Casino and Slots Games. You Keep From Your Gambling Winnings. 15 Tax Calculators 15 Tax Calculators.

2022 Tax Year Return Calculator in 2023. Discover the best slot machine games types jackpots FREE games. See 72 PA CS.

Simply choose your state on the calculator input your relationship status taxable income winnings and click calculate. According to Pennsylvania law the 36 percent tax is assessed on gross sports. Pennsylvania state taxes for gambling.

DATEucator - Your 2023 Tax Refund Date. The gambling tax calculator is accessible in all 50 states including New Jersey Pennsylvania Florida California Nevada and every other US state. You should report your.

Gambling Winnings Tax Calculator Pa.

Are Gambling Winnings Taxable Top Tax Tips Turbotax Tax Tips Videos

Tax Reform Law Deals Pro Gamblers A Losing Hand Journal Of Accountancy

Best Lottery Tax Calculator Updated 2022 Mega Millions Powerball Lotto Tax

Gambling Winnings Are Taxable Income On Your Tax Return

Individual Income Tax Colorado General Assembly

Arizona Gambling Winnings Tax Calculator 2022 Betarizona Com

Maryland Gambling Winnings Tax Calculator Betmaryland Com

Are Gambling Winnings Taxed The Motley Fool

Filing Out Of State W 2g Form H R Block

Kansas Department Of Revenue Kw 100 Kansas Withholding Tax Guide

1040 Tax Calculator Home Loan Investment Bank

:max_bytes(150000):strip_icc()/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Guide Filing How To S

New York Gambling Winnings Tax Calculator For November 2022

Hawaii Income Tax Hi State Tax Calculator Community Tax

Income Tax Calculator 2021 2022 Estimate Return Refund

Tax Calculator Gambling Winnings Free To Use All States

The Ultimate Guide To Gambling Tax Rates Around The World